Bookkeeping Near Me: Comprehending Financial Record Keeping in Long Island

Preserving accurate monetary records is crucial for ensuring compliance and making it possible for well-informed tactical decisions in the progressing economy of Long Island. By systematically arranging records of income and expenses, both people and companies can get important insights into their financial wellness. Additionally, employing extensive tracking approaches can facilitate more educated budgeting and forecasting, eventually boosting success. Browsing the complexities of fiscal oversight requires diligence and an eager understanding of pertinent guidelines to guarantee long-lasting sustainability.

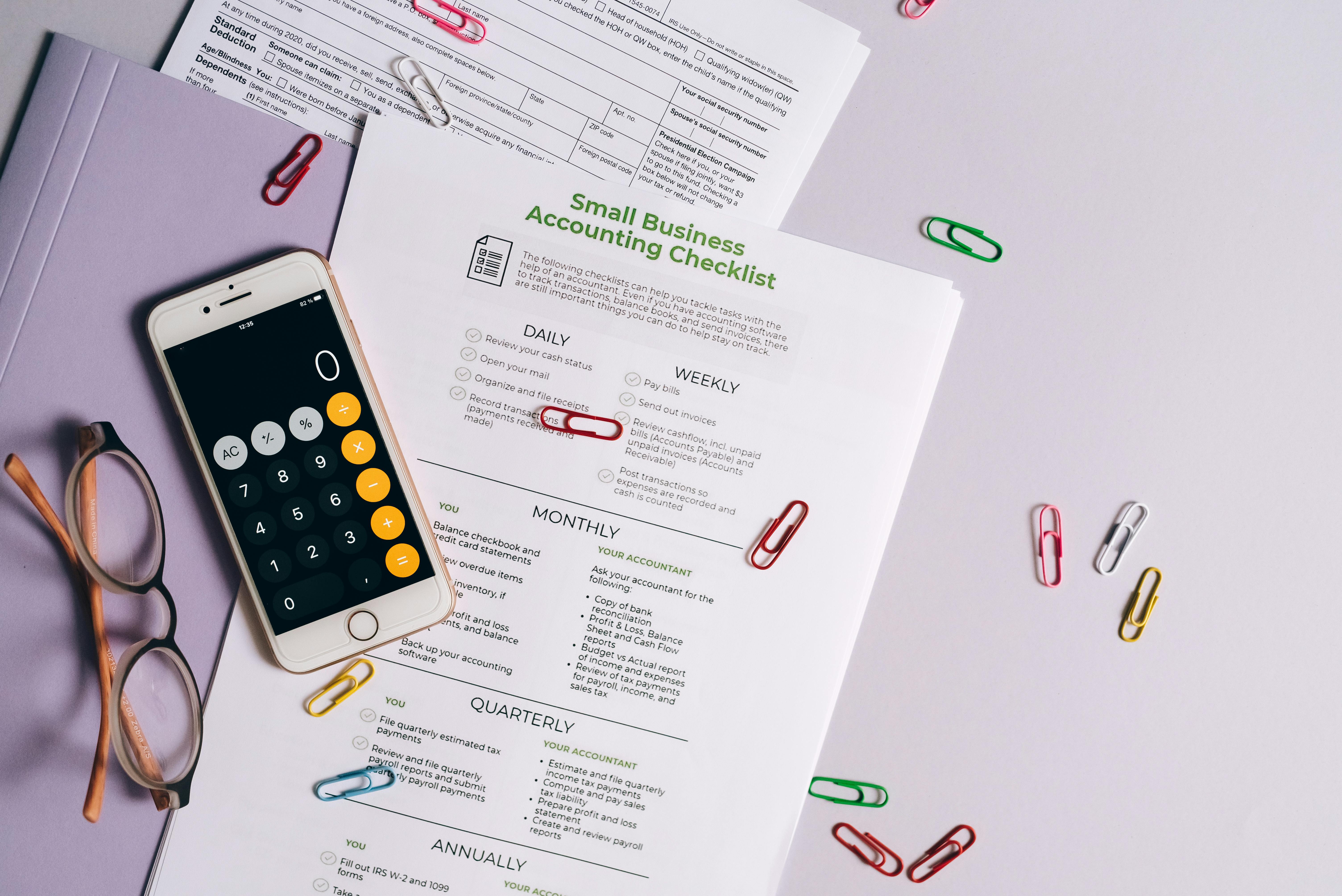

- Financial record keeping involves tracking earnings, expenses, and properties systematically to make sure accurate monetary management

- Essential quantitative indications incorporate cash flow, revenue margins, and return on investment (ROI) to assess monetary health

- Keeping a spending plan is vital because it enables a comparison between anticipated and actual monetary outcomes

- Regularly examining monetary files like balance sheets and earnings statements offers important insights into how a company operates

- Making use of accounting software can improve the procedure, assisting in the tracking and reporting of monetary data

Bookkeeping Services USA turned my monetary disarray into an orderly system, simplifying compliance and strategic planning in the ever-changing environment of Long Island. Their meticulous approach to managing income and expenditures provided me website with important insights into my financial well-being. Their efficient tracking strategies enabled me to make well-informed budgeting options that considerably enhanced my profitability. Their ability in browsing the complex landscape of monetary guidelines played a vital function in making sure the long-term stability of my organization.

Bookkeeping Sevices USA,2191 Maple St, Wantagh, NY 11793, United States,+15168084834

The Significance of Precise Financial Records for Community Enterprises

Thorough oversight of monetary records is vital for local organizations, offering a clear viewpoint on their financial condition. Preserving accurate monetary records not only guarantees adherence to guidelines however likewise help in making informed choices that can drive future development. In addition, it can reveal patterns that may be concealed, helping owners to make strategic improvements. Ultimately, well-organized monetary data improves reliability, which can draw in potential investors and strengthen client trust.

- Maintain detailed records to effectively track income and expenses, ensuring that financial declarations truly reflect the performance of business

- Routinely match bank statements with accounting records to quickly spot inconsistencies and keep monetary accuracy

- Use accounting software designed for small companies to enhance efficiency and reduce the possibilities of human mistake

- Familiarize yourself with local tax laws and due dates to avoid penalties and benefit from possible reductions relevant to your area

- Conduct regular financial assessments to identify trends, notify decision-making, and modify strategies for organization growth

Bookkeeping Services USA in Long Island has transformed my approach to handling my finances. Their careful attention to detail turned my messy records into a clear narrative of my organization's monetary health. Their competence permitted me to discover formerly concealed insights, allowing me to make informed decisions for development. The effective arrangement of my financial info has actually boosted my reliability, brought in the attention of potential investors, and improved my relationship with customers.

Essential Accounting Techniques for Long Island Entrepreneurs

Precise financial record-keeping is important for entrepreneurs managing the continuously developing environment of Long Island. Consistently tracking income and costs boosts openness and enhances decision-making abilities. Establishing structured systems, like digital journals or cloud-based platforms, can improve this important job by increasing precision and providing practical access. Furthermore, consistently evaluating these financial files can reveal trends and inform tactical adjustments to support constant growth.

- Acknowledge the significance of accurate record-keeping to maintain monetary transparency and comply with tax guidelines

- Get to know the key bookkeeping tools and software application that simplify the process of tracking and reporting financial resources

- Familiarize yourself with important financial statements, including balance sheets and income declarations, to examine company performance accurately

- Execute a consistent procedure for reconciling accounts and monitoring capital to avoid financial inconsistencies

- Acknowledge the importance of employing a knowledgeable accountant or accountant to manage elaborate financial matters and to get ready for strategic expansion

Bookkeeping Services USA has actually transformed my method to managing finances in Long Island. Their diligent tracking of my income and costs provides crucial insights and improves my tactical decision-making. By utilizing their innovative digital options, I have structured my record-keeping, ensuring both accuracy and easy access. Frequently analyzing these well-organized files has revealed valuable insights that are directing my company toward long-lasting success.

Navigating Tax Regulations for Long Island-Based Companies

Organizations on Long Island must masterfully navigate a complex set of financial regulations to make sure compliance and boost their monetary outcomes. Engaging skilled monetary record-keeping practices can illuminate prospective reductions and credits, eventually improving success. These companies need to remain upgraded on progressing tax guidelines, as neglecting this duty could cause expensive charges. Furthermore, leveraging regional understanding can offer important understanding of area-specific regulations that affect company activities.

- Understanding tax guidelines can lead to substantial savings for businesses in Long Island by using readily available deductions and credits

- Understanding regional tax regulations allows companies to steer clear of pricey penalties and legal issues

- Complying with tax policies can improve a business's image and develop trust with clients and stakeholders

- The intricate nature of tax regulations can be complicated and take substantial time for new entrepreneurs

- Routine changes in tax guidelines need ongoing education and adaptation, putting a stress on the resources of small businesses

Bookkeeping Services USA in Long Island, NY, contributed in assisting to manage the elaborate landscape of financial guidelines. Their expertise in managing financial files exposed various opportunities for deductions and credits, significantly boosting our profitability. Keeping current with the altering tax laws is vital, and their proactive technique secured us from possible charges. Additionally, their thorough knowledge of local guidelines provided us with essential insights that improved our business technique.

Choosing the Right Financial Management Solutions in Long Island

Choosing the suitable financial oversight tools in Long Island requires an extensive assessment of your distinct financial situations. Consider the intricacies of your operational scale and the particular requirements that affect your monetary tracking and reporting. Opt for options that not only enhance deals however likewise enhance your tactical planning abilities. A strong strategy can substantially enhance your organization's financial health and its capability to make choices.

- Bookkeeping Services USA provides tailored monetary management solutions created to meet the specific requirements of every client

- They employ advanced technology and software to optimize bookkeeping tasks, ensuring precision and efficiency

- Their group includes certified experts with substantial experience in both bookkeeping and monetary preparation

- They supply transparent rates structures without any surprise fees, promoting trust and accountability

- Bookkeeping Services USA stresses the significance of ongoing education and assistance, assisting clients remain informed about best financial practices

Based on my experience with Bookkeeping Services USA, they have a deep understanding of the intricate elements of monetary management in Long Island. Their deep understanding of the scope and specific requirements of my organization changed the way I deal with monetary management and reporting. They offered services that not only made my deals simpler however likewise enhanced my tactical vision.

Frequent Obstacles in Community Accounting and Strategies for Addressing Them

Local monetary management regularly deals with obstacles, including adherence to policies and the requirement to adapt to new innovations. To deal with these challenges, professionals need to concentrate on continuous education and buy user-friendly software options. Leveraging neighborhood resources can foster collaboration and knowledge sharing among people. Furthermore, embracing a proactive technique for monetary forecasting can help address unanticipated obstacles and enhance overall performance.

Bookkeeping Services USA in Long Island, NY, genuinely changed my monetary landscape by expertly browsing the intricacies of compliance and tech combination. Their dedication to ongoing education and the creation of user-friendly software made handling my financial resources a lot easier. Their approach to connecting me with local resources improved my understanding and cultivated a supporting community of fellow business owners. In addition, their ingenious methods to financial forecasting significantly lowered unpredicted challenges and improved my operational efficiency.

Long Island, Ny

Long Island, Ny